Qplix

Private Equity Management Software

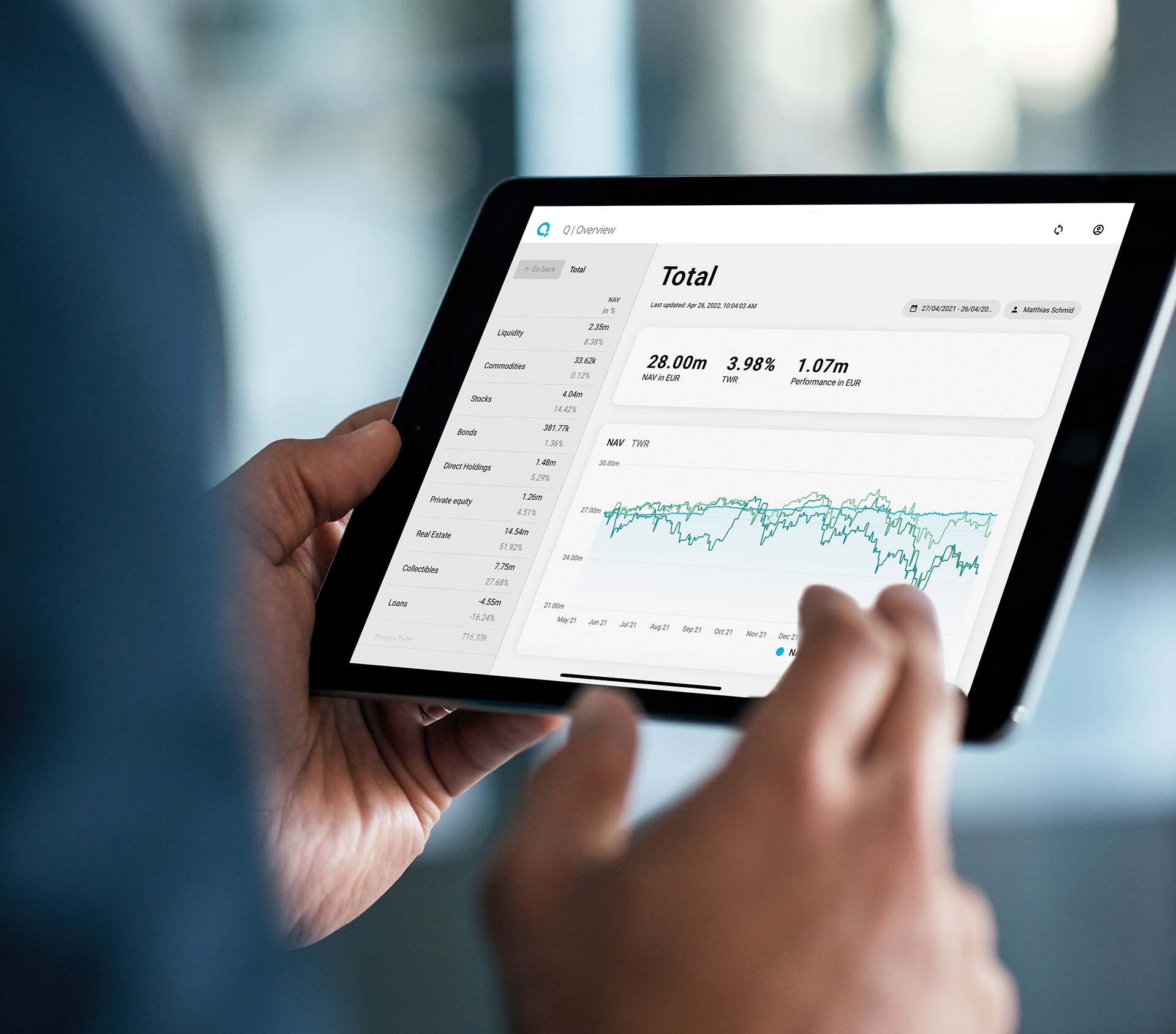

Manage private equity digitally

Private equity gains weight in the portfolios of family offices and institutional investors. However, it can be challenging to manage direct investments or PE funds as they are still associated with paperwork or Excel-based calculations and handled separately from other asset classes. This results in redundant processes as well as inefficient and error-prone manual work. With QPLIX and its strong illiquid asset management and analytics capabilites, you can automate reporting, accounting and controlling and gain visibility of your private equity investments in the context of the complete portfolio. The digitalisation and consolidatiopn of all asset classes (liquid, illiquid, and alternatives) in one single software lifts efficiency and transparency to a new level.

One single software for any kind of illiquid, liquid or alternative asset class

- One single software for liquid, illiquid and alternative assets

- Strong private equity and PE fund management capabilites

- Forecasting tools (such as J-Curve)

- Manage capital calls, pay-outs and liquidity

- Access to all documents of each asset and transaction

- 360° overview of the entire wealth

- App, web portal and PDF reports

- Powerful analytics tools

- Seamless, fully integrated workflows

- Automated back office processes

- Accessible anytime and anywhere

- Integrated payment management

Private equity software tools complete digital wealth management

All asset classes under control

QPLIX wealth management software consolidates all liquid, illiquid and alternative investments and offers sophisticated management and anlytics tool for each asset class. From securities to collectibles, real estate, private equity to art: Unified financial reporting provides your team with a "near real time" overview of the complete portfolio within complex ownership structures. With tools for ESG valuations and alternative asset management, you serve the highest demands, including those of the next generation.

Focus on creating value - we take care of the rest

QPLIX simplifies your daily operations. The software increases the efficiency of your team by automating processes around data consolidation, accounting, controlling, and reporting. Freed from mundane tasks, you can concentrate on outperforming investment goals and on creating added value for clients or supervisory bodies. No need to care about marekt or transaction data supply, IT infrastructure or security - QPLIX is Software a a Service. All you need is a digital device and an internet connection.

Outperform customer expectations

With our software, you can offer a digitall experience that meets the highest standards. Your clients and stakeholders can clearly see the value you create on web dashboards and reports. Tech-savvy cleints will love the QPLIX Wealth App: Branded in your corporate design, it offers an overview of their personal wealth anytime and anywhere. The QPLIX portal enables your managers to answer individual questions in real-time and play through investment scenarios.

Always at your side

QPLIX is more than a software provider. We see ourselves as a partner who accompanies you with profound, practical expertise during the digital transformation and ensures that all aspects of your business remain up to date. We employ roughly the same number of software and financial experts to help you get the most out of QPLIX. You can always rely on their support, proactive advice, and discretion. Together, we’ll turn your firm into a highly modern, data-driven business.

Our Customers

See how QPLIX digitalises wealth management

For a software demo, please fill out the form.

(Fields with * are mandatory. Please also check the "privacy box" in the bottom left corner)