QPLIX SOFTWARE

FOR FAMILY OFFICES

Family Office expertise

What is family office software about? We think it's basically about managing complex portfolios and mapping complex ownership structures. We know because family offices are our turf. We, the founders of QPLIX, worked in a German family office. We experienced first-hand the growing complexity and limitations of the technology on the market. We decided to develop our own software based on our practical experience. This was the starting point for QPLIX in 2012. Since then, we have become the wealthtech partner of leading family offices, foundations, private banks, IFAs and institutional investors around the world. You too can transform your office into a modern, data-driven business with QPLIX and its powerful digital portfolio management platform.

Probably the most advanced family office software

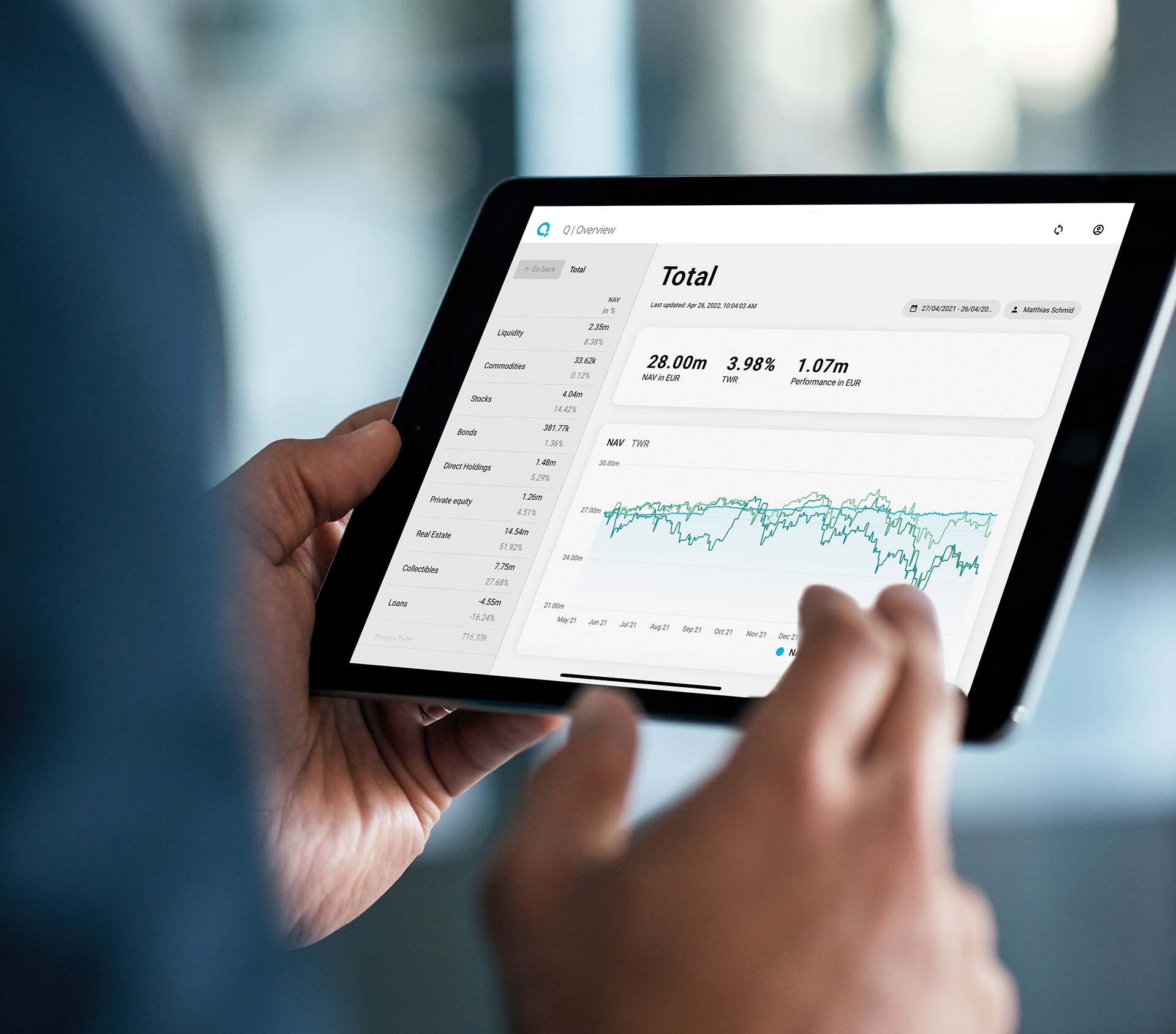

One single system to manage your entire investment portfolio, no matter how complex or diversified.

- Complete spectrum of liquid, illiquid and alternative assets

- Full control of complex portfolios

- Efficiency boost

- Digital services for principals and family members

- 360° overview of the entire wealth

- Consolidates market and transcation data

- Maps any ownership structure

- Powerful analytics capabilities

- Seamless, fully integrated workflows

- Automates your back office processes

- Integrated ordering, payment and document management

- Securely accessible anytime and anywhere

- Personal wealth app and web dashboards

- Consulting and support from finance industry experts

DIGITAL POWER FOR SINGLE AND MULTI FAMILY OFFICES

A single system for all asset classes

A single system for all asset classes

Family office software serves two main purposes: The first is to bring together all liquid, illiquid and alternative investments for consolidated reporting, controlling and overview of the entire portfolio. The second is to provide you with customised and detailed management and analysis tools for each individual asset class. With QPLIX, you can manage securities and their ESG ratings, fixed income, private equity and other "alternatives", even art collections or yachts. It's all about completeness and practicality. Take real estate, for example: QPLIX allows you to manage your property down to individual leases.

Focus on creating value - we do the rest

QPLIX simplifies your daily work. The family office software increases the efficiency of your team by automating processes around data consolidation, accounting, controlling and reporting. Freed from mundane tasks, you can focus on outperforming investment targets and creating value for the family and the principal. As a multi-family office, efficiencies allow you to scale your business. No need to worry about IT infrastructure and security - Software as a Service at its best.

Outperform client expectations

Our family office software enables you to deliver a customer experience that meets the highest standards. Principals and beneficial owners can clearly see the value you create through web dashboards and reports. Tech-savvy family members will love the QPLIX Wealth App: Branded in your corporate design, it provides an overview of their personal wealth anytime, anywhere. The QPLIX portal allows your managers to answer individual questions and to play through investment scenarios in real time.

Your technology partner - always at your side

QPLIX is more than just a software vendor. We see ourselves as a partner who will guide you through your digital transformation with in-depth, hands-on expertise and ensure that all aspects of your business remain up-to-date. We employ roughly equal numbers of software and finance experts to help you get the most out of QPLIX. You can always rely on their support, proactive advice and discretion. Together we'll transform your office into a state-of-the-art, data-driven business.

Our Customers

Related Content from our QPLIX insights blog

THERE'S NO WAY AROUND DIGITALISING YOUR FAMILY OFFICE

As a manager in a single or multi family office, your business becomes increasingly complex and dynamic. You need to handle more and more data feeds, illiquid and alternative investments, and regulatory demands in different jurisdictions globally.

KONTORA AND QPLIX: PARTNERS FOR EFFICIENCY IN WEALTH MANAGEMENT

The relationship between multi-family office Kontora and QPLIX has evolved from a customer-supplier relationship to a close partnership. In this video, Kontora's Florian Hoffmann explains how they digitally manage all asset classes in a single system.

QPLIX RECOGNISED AS WEALTHTECH100 INNOVATION LEADER

The new WealthTech100 list for 2023 was presented by FinTech Global. The prestigious ranking recognises the world’s most innovative solution providers for investment firms, private banks and financial advisors.